“𝐏𝐫𝐨𝐩𝐞𝐫𝐭𝐲 𝐭𝐨𝐡 𝐤𝐚𝐛𝐡𝐢 𝐥𝐨𝐬𝐬 𝐧𝐚𝐡𝐢𝐧 𝐡𝐨𝐭𝐚.”

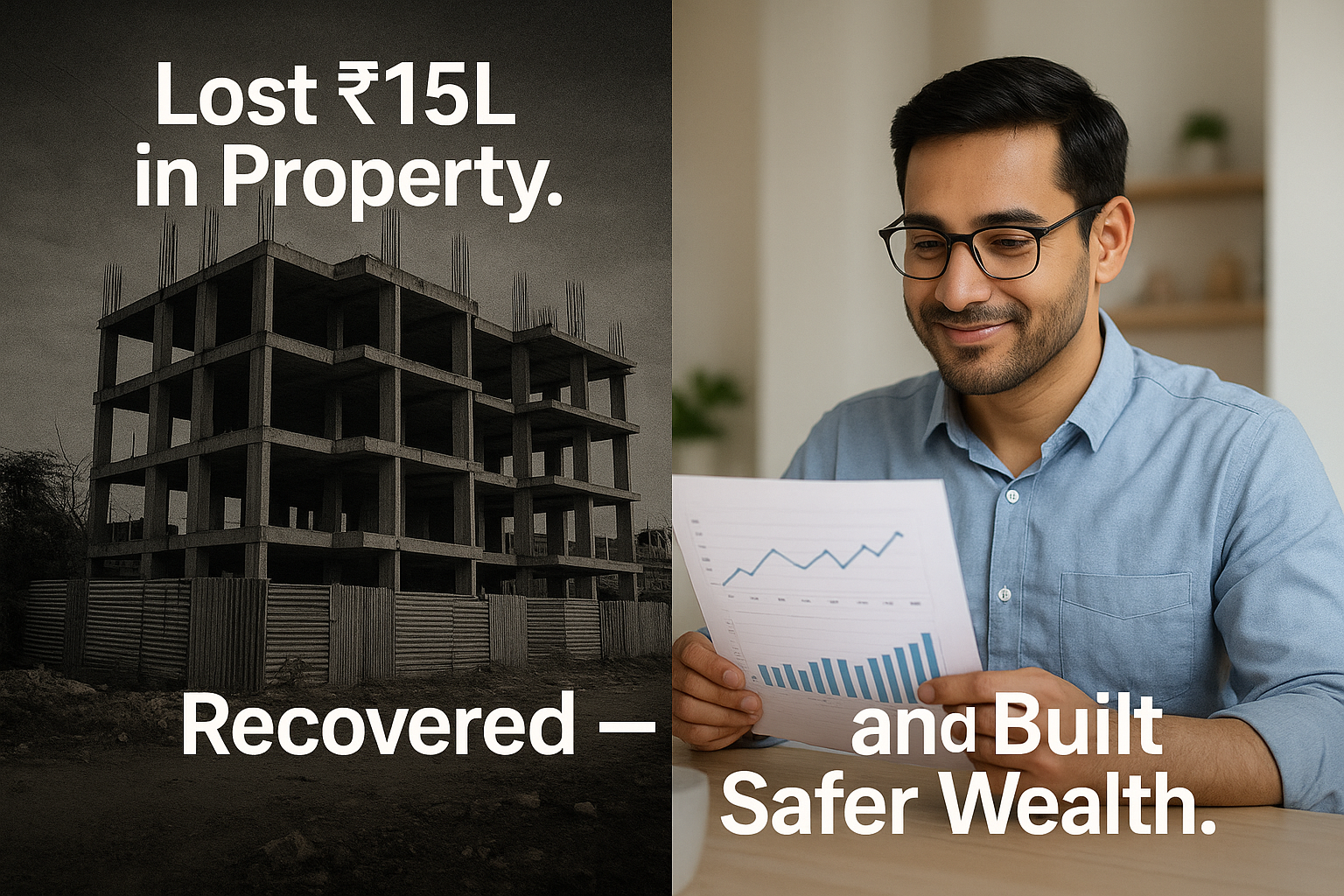

That’s what everyone said when I invested ₹25L in a under-construction property in 2018. Four years later, the builder vanished, and my investment was gone.

The Mistake:

✗ Bought without verifying RERA registration

✗ Trusted word-of-mouth over due diligence

✗ Put all savings into one illiquid asset

✗ Ignored red flags — delayed timelines, vague agreements

✗ Expected quick appreciation without understanding market cycles

The Loss:

→ ₹15L gone (after legal battles recovered ₹10L only)

→ 4 years of financial stress

→ Marriage plans delayed

→ Lost opportunity cost of ₹5L+ (if invested in equity)

The Recovery: After hitting rock bottom, I rebuilt from scratch:

✅ Started SIP with just ₹5K/month in index funds

✅ Built emergency fund = 12 months expenses

✅ Diversified: 60% equity, 30% debt, 10% gold

✅ Invested in REITs for real estate exposure (without liquidity trap)

✅ Only invest what I understand — no speculation

✅ Focused on building skills → income grew 3x in 5 years

Today’s Portfolio:

₹30L+ across mutual funds

REITs, and FDs — liquid, transparent

And growing at 12%+ CAGR.

Lessons Learned:

🔑 Real estate isn’t always safe — liquidity matters

🔑 Due diligence > FOMO

🔑 Diversification protects you from catastrophic loss

🔑 Financial literacy = your best insurance

Lost money taught me what no course could.

Drop a 💪 if you’ve bounced back from a financial setback.

Follow Sushant Sinha for honest stories on money, investing & building wealth the right way.

hashtag#RealEstateInvesting hashtag#FinancialRecovery hashtag#InvestmentMistakes hashtag#WealthBuilding hashtag#PersonalFinance hashtag#MoneyLessons hashtag#SmartInvesting hashtag#FinancialFreedom hashtag#MutualFunds hashtag#REITs