“𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐢𝐚𝐥 𝐩𝐫𝐨𝐩𝐞𝐫𝐭𝐲? 𝐓𝐨𝐨 𝐫𝐢𝐬𝐤𝐲, 𝐬𝐭𝐢𝐜𝐤 𝐭𝐨 𝐟𝐥𝐚𝐭𝐬.”

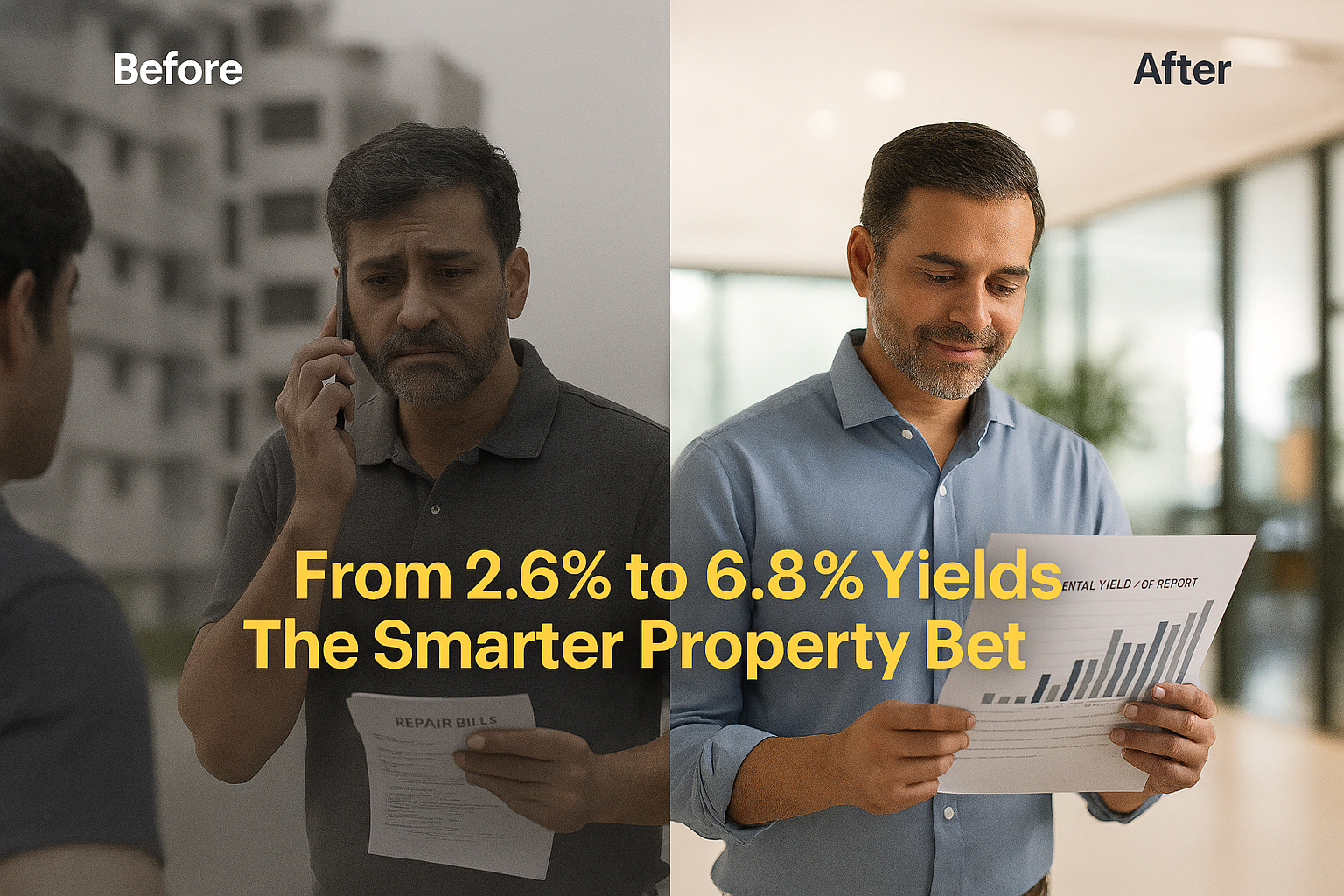

That’s what everyone told me in 2019. But residential rental yields were barely 2-3%, and tenant hassles were endless.

I took a calculated bet on commercial real estate. Today, it’s my most profitable decision.

The Residential Reality: ✗ Bought 2BHK for ₹45L — rental yield just 2.6%

✗ Constant tenant turnover every 11 months

✗ Maintenance complaints, society drama, wear & tear

✗ Rent negotiations every year (always downward)

✗ Vacancy periods eating into returns

The Commercial Shift:

Instead of buying another flat, I invested ₹35L in a 400 sq.ft commercial shop in a busy market area.

✅ Higher rental yields — 6-8% vs. 2-3% in residential

✅ Long-term leases — 3-9 year lock-ins (businesses need stability)

✅ Rent escalation built-in — 10% hike every 3 years (contractual)

✅ Tenant maintains property — No repair headaches

✅ Business tenants = reliable — Rent is their business expense, rarely delayed

My Commercial Property Journey:

→ 2019: Bought 400 sq.ft shop for ₹35L (bank loan ₹20L)

→ Tenant: Small accounting firm (9-year lease)

→ Monthly rent: ₹20,000 (₹2.4L/year)

→ Yield: 6.8% (nearly 3x residential)

→ EMI: ₹18K/month (rent covers 100%+ of EMI)

→ Effort: Zero — tenant handles everything

The Tax Advantage: → Commercial property loan interest fully deductible

→ Depreciation benefits reduce taxable rental income

→ Capital gains indexation on sale (long-term)

The Risks I Evaluated: ⚠️ Higher upfront cost

⚠️ Location-dependent (visibility = everything)

⚠️ Business closure risk (mitigated with prime location)

⚠️ Lower liquidity than residential

Today’s Reality (After 6 Years): → Loan almost paid off (₹4L remaining)

→ Property value appreciated to ₹48L

→ Passive income: ₹2.4L/year (growing to ₹2.6L after escalation)

→ Planning second commercial investment

Lessons Learned:

🔑 Commercial isn’t riskier — it’s different (do your homework)

🔑 Location > property size (footfall = rent potential)

🔑 Long leases = peace of mind + predictable cash flow

🔑 Diversify: Residential for living, commercial for earning

Residential gave me a home. Commercial gave me freedom.

Drop a 🏢 if you’ve considered commercial property investing.

Follow Sushant Sinha for honest insights on real estate, passive income & building wealth strategically.

hashtagCommercialRealEstate hashtagPassiveIncome hashtagRealEstateInvesting hashtagRentalIncome hashtagWealthBuilding hashtagPropertyInvestment hashtagFinancialFreedom hashtagSmartInvesting hashtagRealEstateTips hashtagInvestmentStrategy