In today’s unpredictable world of stocks, mutual funds, and volatile market trends, there are two investment instruments that have stood the test of time in India — Fixed Deposits (FDs) and Recurring Deposits (RDs).

For decades, they have been the go-to choice for investors who value security, stability, and guaranteed returns over the uncertainty of high-risk investments. These products are simple to understand, easy to manage, and backed by the Deposit Insurance and Credit Guarantee Corporation (DICGC) — which insures each depositor up to ₹5 lakh per bank. This means your money is safe, no matter what happens in the market.

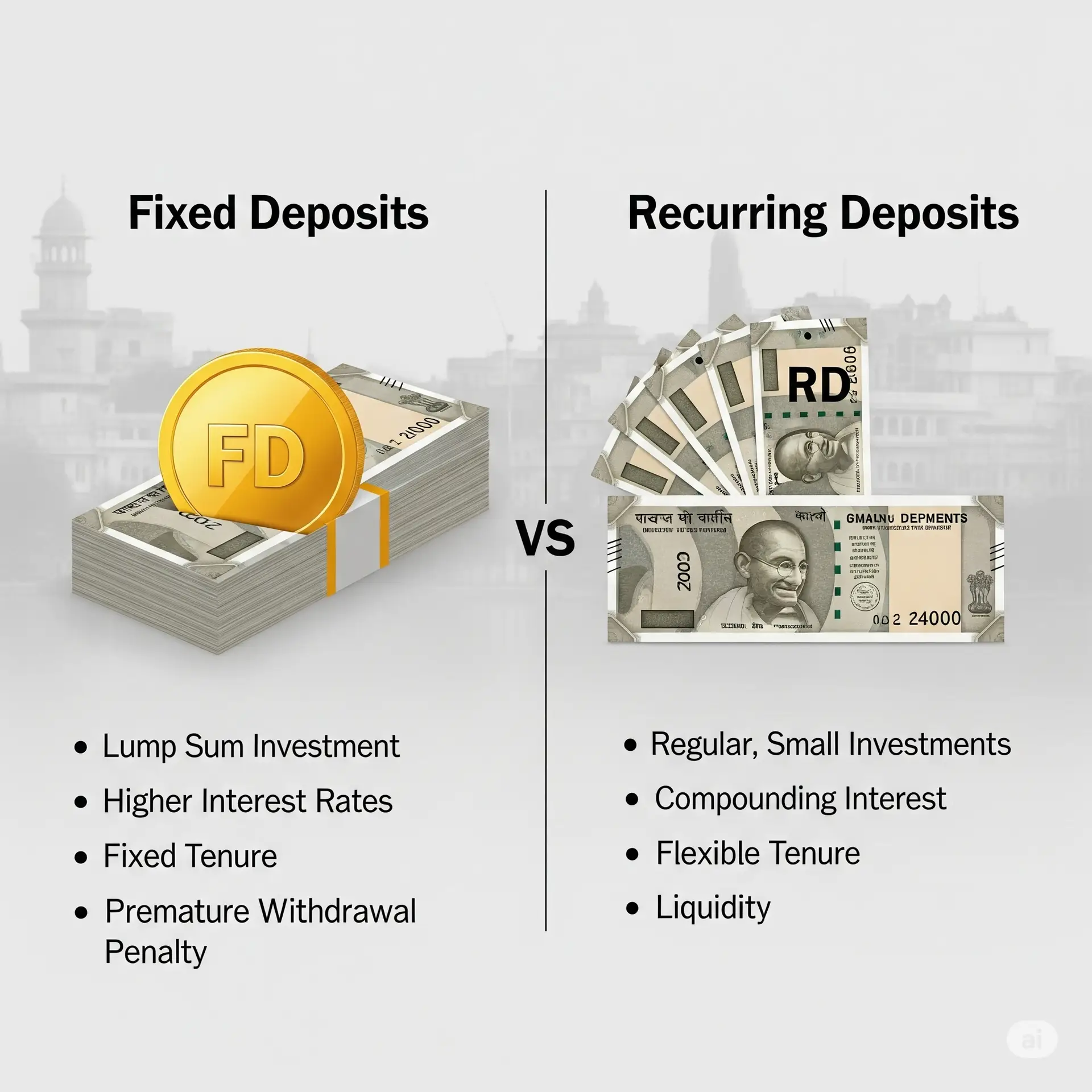

💎 Fixed Deposits (FDs): The Lump-Sum Powerhouse

A Fixed Deposit is a one-time lump sum investment for a fixed tenure at a fixed interest rate.

Who is it for? Investors with a significant amount ready — such as a bonus, inheritance, or maturity amount from another investment.

Key Benefits:

Fixed interest rate for the entire tenure (protection from rate cuts)

Tenure flexibility (from 7 days to 10 years)

Guaranteed maturity amount (makes financial planning easy)

Once invested, your money stays locked till maturity, ensuring discipline and steady growth.

📅 Recurring Deposits (RDs): The Disciplined Saver

A Recurring Deposit allows you to deposit a fixed amount every month for a set period. It’s a great way to build savings gradually while earning better returns than a savings account.

Who is it for? Salaried individuals or anyone looking to save consistently.

Key Benefits:

Encourages regular savings habit

Compounding interest accelerates growth

Perfect for short-term or medium-term goals

With RDs, you don’t need a large initial amount — just commitment and consistency.

🔍 Why Conservative Investors Love FDs & RDs

Low Risk: Immune to market volatility

Predictable Returns: You know exactly what you’ll get at maturity

Senior Citizen Advantage: Extra 0.50%–0.75% interest in most banks

Goal Alignment: Ideal for retirement planning, short-term purchases, or emergency fund parking

📊 Current Rates (Mid-Aug 2025 Snapshot)

FDs: 6.25% – 6.60% (2–3 year tenure, general public)

RDs: Similar range

Senior Citizens: Up to 7.35% in some banks

🚀 Action Step

If you’ve been delaying your savings plan, today is the best day to start.

✅ Check your bank’s latest FD & RD rates (on their website or app)

✅ Match the tenure with your goals

✅ Start now — even a small step compounds into big results over time

In personal finance, it’s not always about chasing the highest returns.

Sometimes, it’s about sleeping peacefully at night, knowing your money is safe and growing.

#Investment #FD #RD #PersonalFinance #FinancialPlanning #Savings #SafeInvestments #India