ICICI Bank Raises Minimum Balance Requirements Amid Strong Performance

ICICI Bank, a top performer in the private sector banking space for the past three fiscal years, has announced a significant increase in its minimum average balance requirements for new savings accounts. This decision comes despite the bank’s robust financial health, marked by a 25% compounded sales growth and a 27% compounded profit growth. The bank’s stock has also seen exceptional returns, delivering a 32% Compound Annual Growth Rate (CAGR) over the last five years.

This move contrasts with the struggles faced by many other banks, which are dealing with rising Non-Performing Assets (NPAs), higher provisions, and sluggish growth.

New Minimum Balance Rules for New Customers

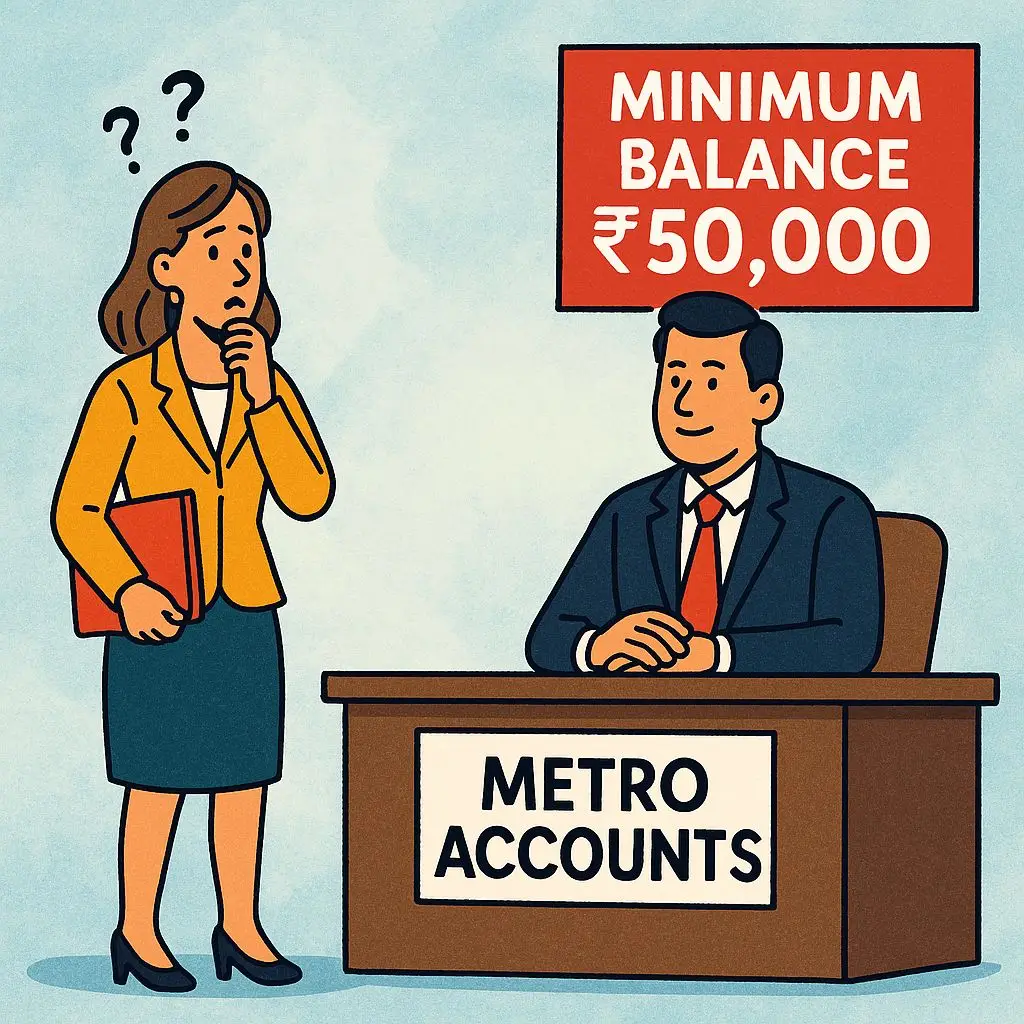

Effective August 1, 2025, new customers opening savings accounts at ICICI Bank will need to maintain higher minimum average balances. The new rules are as follows:

Metros & Urban Areas: The minimum balance has been raised to ₹50,000, a significant jump from the previous ₹10,000.

Semi-Urban Branches: The new requirement is ₹25,000, up from ₹5,000.

Rural Branches: The minimum balance is now ₹10,000, an increase from ₹2,500.

It’s important to note that these new rules do not impact existing customers; they apply only to new accounts opened after the effective date.