India’s iPhone craze is real — sales are up 400% — and a big driver is the magic phrase: “No-Cost EMI.”

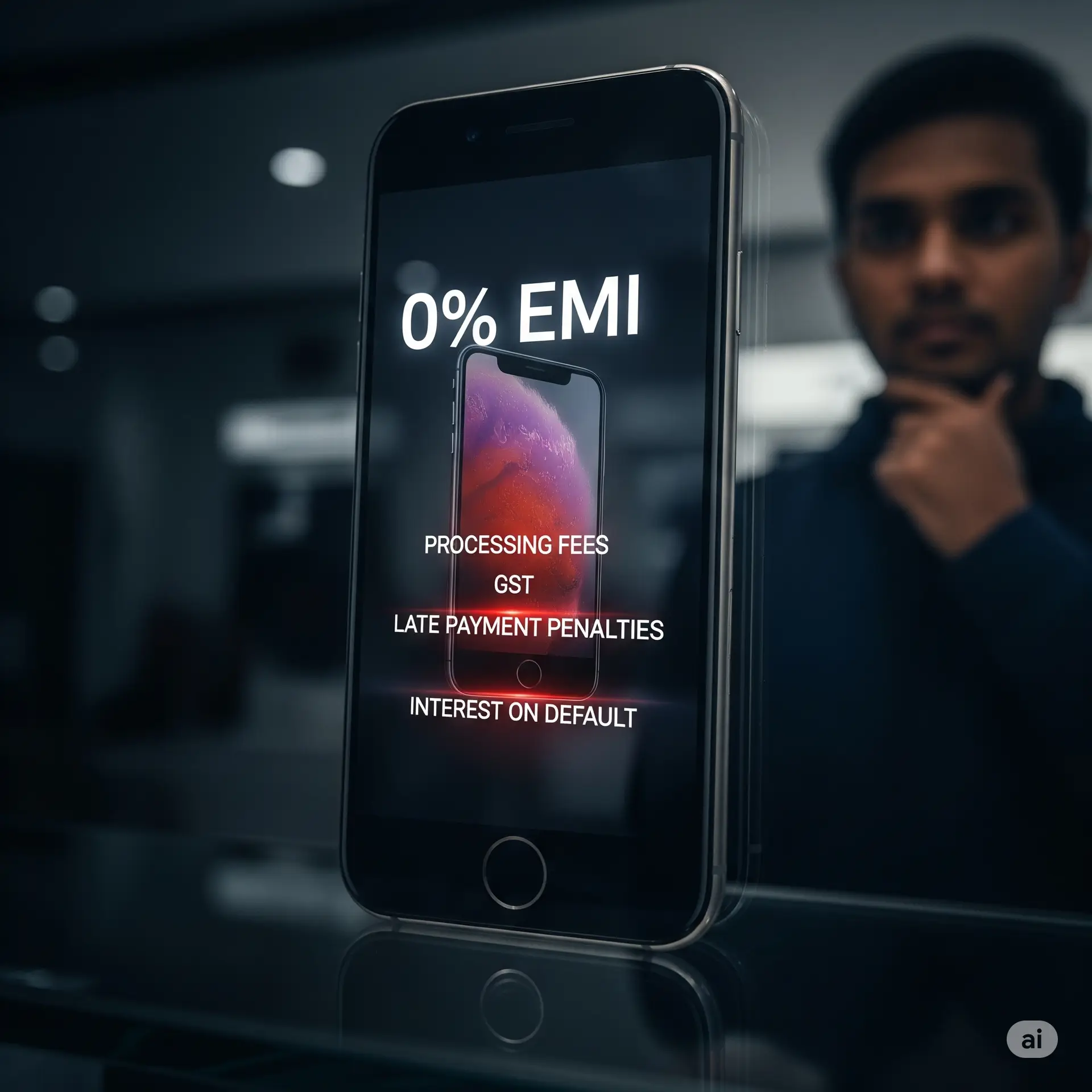

But is it truly no cost? Or just clever marketing?

💡 Here’s the breakdown:

🔹 You Lose Instant Discounts

Pay upfront and you might get ₹5,000–₹10,000 off. On EMI? That discount vanishes.

🔹 Hidden Fees + GST

Processing fees + 18% GST on the fee = more out of your pocket.

🔹 No Price Negotiation

EMI locks you into the sticker price. No bargaining.

Example:

An iPhone tagged at ₹80,000 on “No-Cost EMI” over 12 months sounds great But after lost discounts + fees, you might end up paying ₹85,000+.

📜 RBI Warning

Back in 2013, RBI called zero-percent EMI schemes “misleading.” The label may have changed, but the game hasn’t.

💭 Takeaway:

“No-Cost EMI” isn’t evil — but it’s rarely free.

Before you sign up, read the fine print, calculate the total cost, and decide if the convenience is worth the extra money.

#Finance #PersonalFinance #ConsumerAwareness #EMI #NoCostEMI #FinancialLiteracy #India #SmartShopping #HiddenCosts #MoneyTips