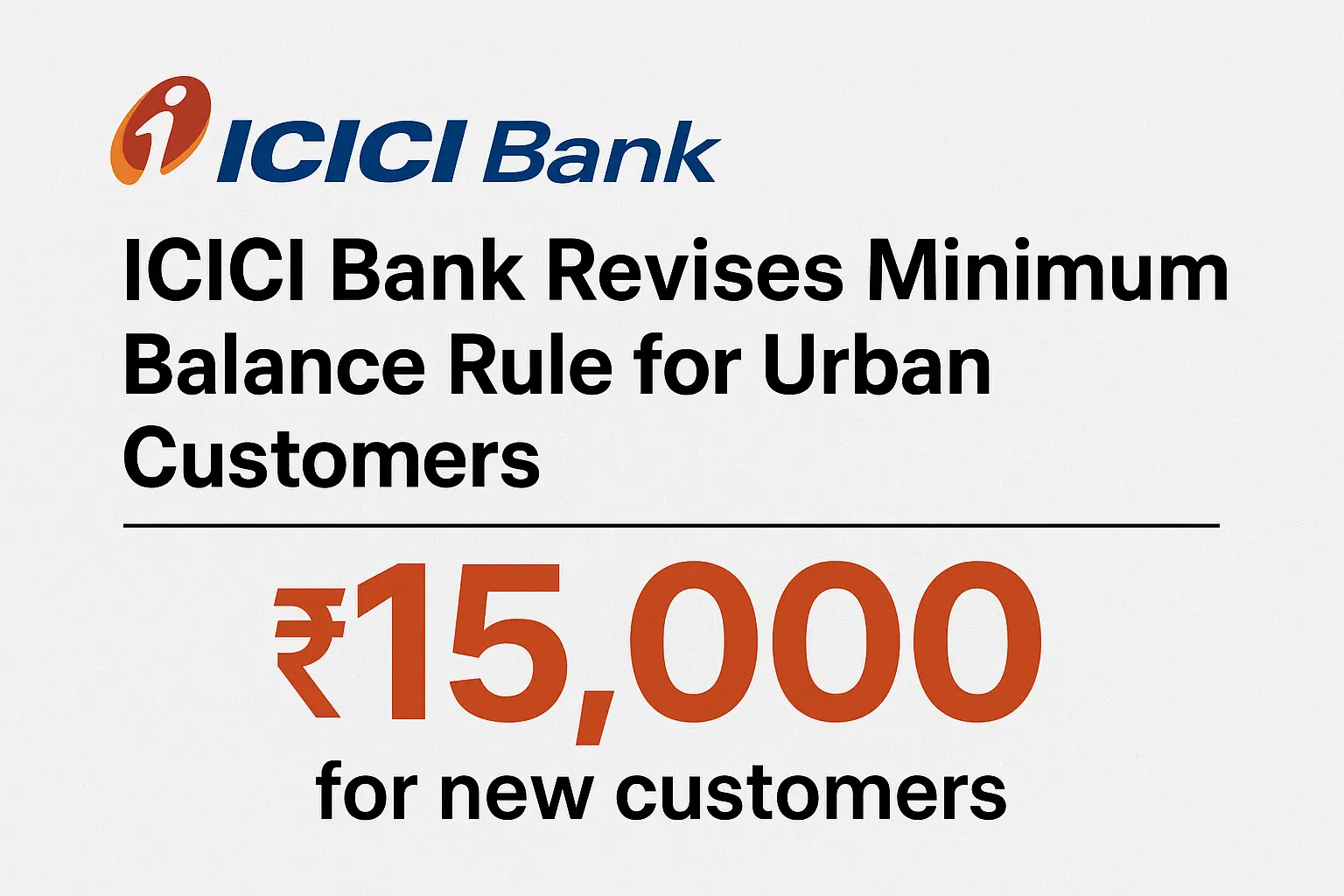

🚨 ICICI Bank Revises Minimum Balance Rule for Urban Customers

In a move that will bring relief to many, ICICI Bank has rolled back its earlier ₹50,000 minimum average balance (MAB) requirement for urban locations.

✅ What’s New?

The bank has revised the MAB to ₹15,000 for new customers in urban areas, easing the burden on account holders who found the ₹50,000 threshold too steep.

💡 Why It Matters:

The earlier high MAB requirement risked pushing many towards account closure or shifting to competing banks.Lowering it makes ICICI Bank’s savings accounts more accessible for salaried individuals, small business owners, and students in cities.

It also aligns with competitive offerings from other leading banks.

📌 What You Should Know:

This revision applies only to new customers in urban locations.

Customers must still maintain the revised ₹15,000 average balance to avoid penalties.

The move reflects a growing trend in Indian banking towards customer retention and inclusivity.

💬 My take: Lowering entry barriers is a smart move—especially in today’s competitive retail banking space. While digital banking and fintech wallets grow rapidly, banks still need to ensure physical accounts remain attractive, affordable, and customer-friendly.

What do you think—will more banks follow this path and reduce their MAB requirements?

hashtagICICIBank hashtagBankingNews hashtagPersonalFinance hashtagFinancialLiteracy hashtagBankingUpdates hashtagMoneyManagement hashtagCustomerExperience