Hot vs Cold Wallets in 2025 – Which is Right for You?

I still remember the day my friend lost $3,000 worth of crypto. Not from a bad trade or a market crash, but from something much simpler – he kept everything in the wrong type of wallet.

That conversation changed how I think about crypto storage forever, and today I want to share what I’ve learned so you don’t make the same mistake.

The Golden Rule of Crypto

Here’s the truth nobody talks about enough: your crypto is only as safe as where you store it. You could be the world’s best trader, but if your storage game is weak, you’re one hack away from losing everything.

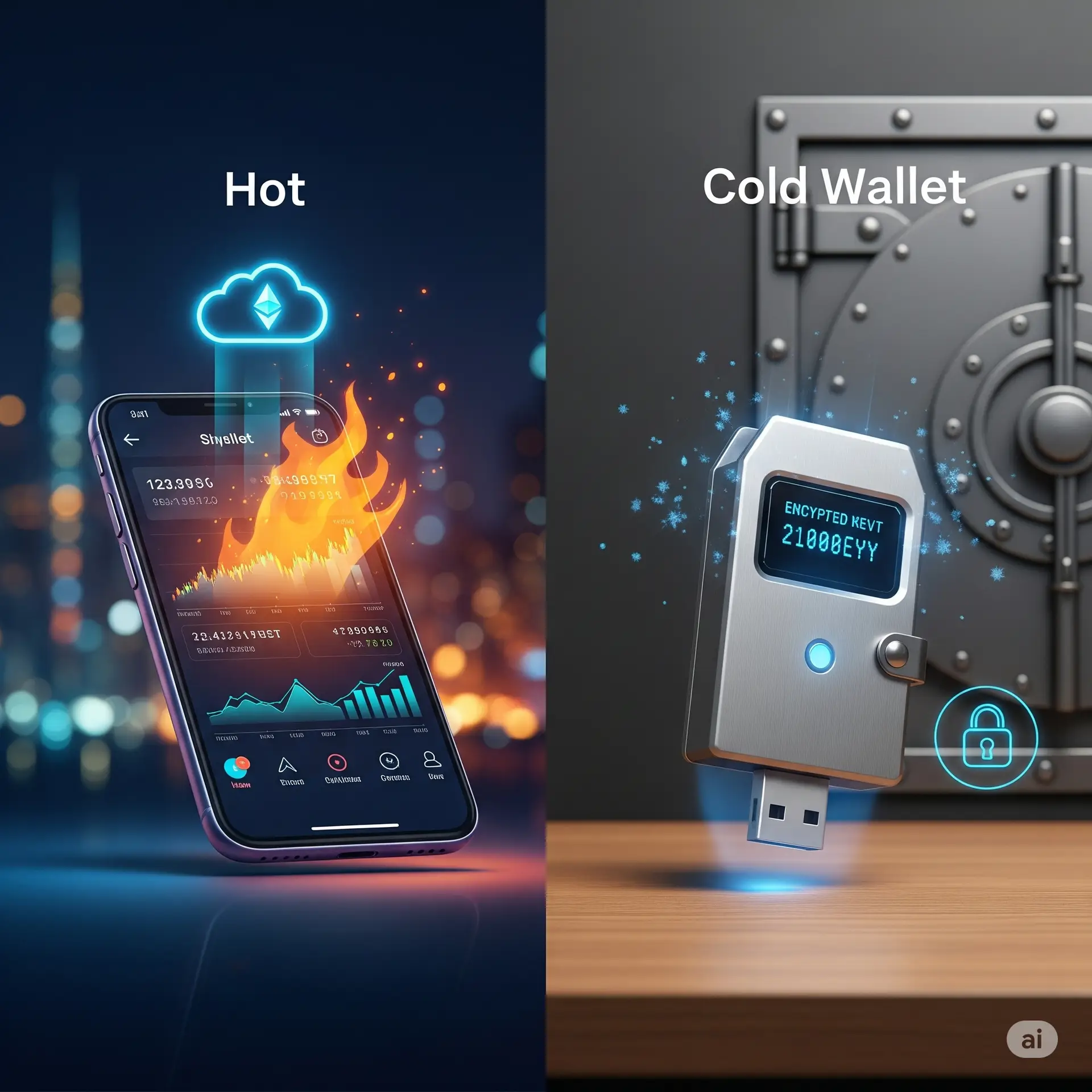

So let’s talk about the two main options: hot wallets and cold wallets. Think of it like deciding between keeping cash in your pocket versus a bank vault – each has its place.

Hot Wallets: Speed at a Price

Hot wallets are always connected to the internet. They’re like having crypto cash in your digital pocket – super convenient, but also exposed.

Popular examples include MetaMask, Trust Wallet, and Coinbase Wallet. If you’ve ever bought crypto on your phone or traded on a decentralized exchange, you’ve probably used one.

The good stuff: They’re incredibly user-friendly. Setting up MetaMask takes maybe five minutes, and boom – you’re ready to trade, buy NFTs, or explore DeFi. Most are free, and you get instant access to your funds 24/7.

The catch: Being online makes them vulnerable. Hackers love targeting hot wallets because they’re easier to access. Plus, some exchanges actually control your private keys, which means you’re trusting them with your money.

I learned this lesson when a popular exchange got hacked last year. Users who kept large amounts there had to wait months to get their funds back – if they got them back at all.

Cold Wallets: The Digital Safe

Cold wallets are the opposite – completely offline. Think hardware devices like Ledger or Trezor, or even old-school paper wallets where you literally write down your keys.

Why they’re great: Maximum security. Since they’re offline, hackers can’t touch them remotely. You have complete control over your private keys, and they’re perfect for storing large amounts long-term.

The downside: They cost money (usually $50-200), and they’re not convenient for frequent trading. Plus, if you lose the device or forget your recovery phrase, your crypto is gone forever. No customer service can help you there.

My Personal Strategy (And What I Recommend)

After watching friends lose money and making my own mistakes, here’s what actually works:

For beginners or active traders: Start with a reputable hot wallet, but never keep more than you can afford to lose. I use MetaMask for DeFi experiments and small trades, but I never keep more than $500-1000 there.

For long-term investors: Get a hardware wallet yesterday. I moved 90% of my holdings to a Ledger after Jake’s incident, and I sleep much better now.

The smart approach: Use both. Keep your “spending money” in a hot wallet for convenience and your “savings” in cold storage for security.

Essential Safety Tips I Wish Someone Told Me Earlier

Never, ever share your seed phrase with anyone – not even customer support claiming to “verify” your account. Enable two-factor authentication on everything. Don’t put all your crypto in one basket, whether hot or cold. And please, double-check every link before connecting your wallet – phishing sites are everywhere.

The Bottom Line

Choosing between hot and cold wallets isn’t really a choice – it’s about using the right tool for the right job. Hot wallets for convenience and small amounts, cold wallets for security and long-term storage.

The crypto space is evolving fast, but one thing remains constant: your security is in your hands. Make smart choices now, and your future self will thank you.

What’s your wallet strategy? Are you team hot, team cold, or somewhere in between? I’d love to hear about your setup and any lessons you’ve learned along the way.

CryptoWallet hashtagCyberSecurity hashtagCryptoSafety hashtagBlockchainSecurity hashtagDigitalAssets hashtagFinanceTips hashtagCrypto2025 #Day04 #CryptoCurrency