Ever felt like your paycheque disappears faster than a magician’s rabbit? 💸

You’re not alone. In today’s consumer-driven world, it’s easy to overspend — often on things we think we need but actually don’t.

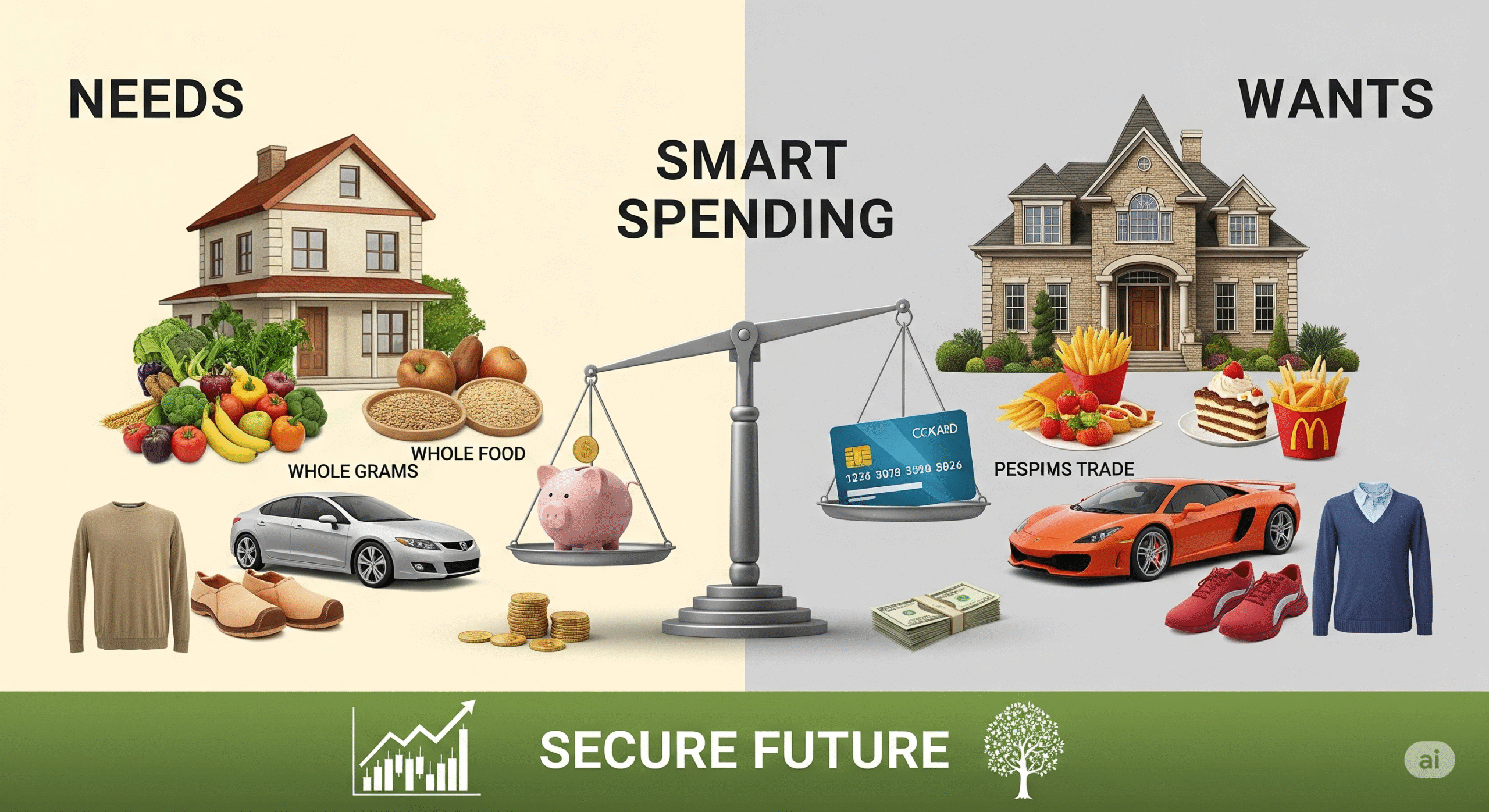

One of the most powerful money habits you can develop is understanding the difference between needs and wants.

What’s the Difference?

Needs → Essentials for survival and well-being.

(Food, rent, utilities, basic clothing, transportation, healthcare)

Wants → Things that make life more enjoyable, but aren’t essential.

(Designer handbags, latest smartphones, luxury apartments, daily gourmet coffee)

The problem? Many of us treat wants like needs — justifying purchases with lines like “I deserve this” or “Everyone has it these days.”

Quick Test: Is It a Need or a Want?

Before buying, ask: “If I don’t get this, will it affect my survival or basic well-being?”

Grocery shopping → ✅ Need

Pre-cut, organic veggies from a luxury store → ❌ Want

Reliable car for work → ✅ Need

Brand-new SUV when your old car works fine → ❌ Want

The Smart Spending Formula

1️⃣ Budget for Needs First → Rent, utilities, food, healthcare.

2️⃣ Calculate Discretionary Income → What’s left after needs.

3️⃣ Mindfully Allocate for Wants → Choose the ones that bring real value to your life.

This doesn’t mean eliminating all wants. Instead, it’s about intentional spending — being in control of your money instead of letting it control you.

Why It Matters

Mastering the needs vs wants habit builds:

✅ Financial stability

✅ Emergency preparedness

✅ Freedom to save for big goals (house, retirement, dream vacation)

Remember: Smart spending isn’t about being cheap — it’s about being intentional.

💬 What’s one “want” you’ve consciously cut back on to improve your finances?

#PersonalFinance, #Budgeting, #SmartSpending, #FinancialLiteracy, #NeedsVsWants